PERSONALIZED TAX EFFICIENT STRATEGIES

Making use of all beneficial provisions in the tax laws.

Insured Philanthropic Contract®

The Insured Philanthropic Contract® (IPC) is a proprietary marketing name for THE SAFEST GIFT ANNUITY utilizing a 501(c)(3) nonprofit who partners and reinsures their contracts with some of the oldest and largest commercial insurance companies in the United States. These insurance companies manage the money on behalf of the nonprofit and guarantee the payments owed to you for the rest of your life regardless of how the markets perform.

Guarantees Really Do Matter . . .

OBJECTIVES

The objective is to help clients rescue tax trapped assets that have appreciated in value without triggering a large upfront capital gain tax. This strategy allows you to reduce market risks and rebalance your investment portfolio. It also provides you a tax-efficient way to permanently exit real estate ownership when you’re finished doing 1031 exchanges. Properly structured, it can be an integral part of your estate planning process.

The Insured Philanthropic Contract® earns you an immediate tax deduction that may be used this year. This maximizes tax benefits by making use of long-standing provisions in the federal tax codes for your benefit.

INCOME

The income can start immediately or be designed to start at a future date which you choose. When your income starts, your check will be direct-deposited into your bank account. You will receive the 1099-R statement at the end of every year directly from the insurance company making the payments on behalf of the nonprofit.

This income is tax favored under IRC 72(b)(2). Only a portion of it is reported as taxable because of the exclusion ratio under 26 CFR §1.72-4. The “exclusion ratio” is stated as a percentage and refers to the portion of an annuity payment which is NOT subject to federal income tax when received during your life expectancy.

TAX DEDUCTION

You earn a tax deduction under U.S. Code 26 §170 as a result of this charitable transaction. The deduction may be used to offset up to 60% of the donors A.G.I. (Adjusted Gross Income), if the transaction is funded with cash.

If the transaction is funded with anything other than cash the tax deduction can be used at 30% of the donor’s A.G.I. (Adjusted Gross Income).

Your tax deduction may be used this year. All unused portions of the deduction may be used in the next five succeeding tax years. Any deductions not used after this period will be lost. You may be able to lower your federal taxes by itemizing deductions on Schedule A (Form 1040).

FUNDING is Easy, Safe, and Secure

You can fund your Insured Philanthropic Contract® with cash that is under performing at the bank or in money markets, securities you would like out of the market, real estate that has appreciated since you purchased it, art that you would like to exchange for retirement income or almost any asset as long as there is a ready market and it can be easily converted to cash by the nonprofit.

You’ve lived with risks, you don’t have to retire with them.

BENEFITS

Avoids triggering a large upfront capital gain tax when funding with an (Appreciated Asset)

Creates a tax deduction you may use this tax year

Creates an immediate or a deferred tax favored income (Private Pension)

Insures a lifetime income regardless of how long you live

Provides you peace of mind knowing you can’t outlive your income during retirement

Deductions may be used to offset RMD distributions from your IRA

Deductions may be helpful in the conversion of your Traditional IRA to a ROTH IRA

May be an integral part of your estate planning process

501(c)(3) ORGANIZATION

Section 501(c)(3) organizations that are tax-exempt under Section 501(a) are defined as: “Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the provision of athletic facilities or equipment), or for the prevention of cruelty to children or animals, no part of the net earnings of which inures to the benefit of any private shareholder or individual, no substantial part of the activities of which is carrying on propaganda, or otherwise attempting to influence legislation except as otherwise provided in subsection(h), which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office.

THE DONOR(S) SHOULD NOTE THAT THEY ARE NOT RECEIVING LEGAL, TAX, ACCOUNTING, OR INVESTMENT ADVICE FROM A 501(c)(3) NON-PROFIT ORGANIZATION OR ITS TRUSTEES, OFFICERS, DIRECTORS, AGENTS, REPRESENTATIVES, VOLUNTEERS OR INDEPENDENT CONTRACTORS.

CHARITABLE ANNUITY

HISTORY

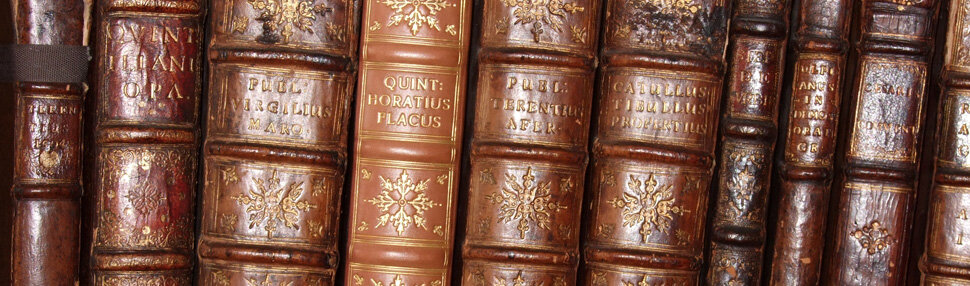

John Trumbell, an American artist during the American Revolutionary War, is credited with the creation of the first charitable gift annuity (CGA) when, in 1831 he sold a series of 28 paintings and 60 miniature portraits to Yale University in exchange for a $1,000 annuity for the rest of his life. Trumbell and his attorney Peter Augustus Jay adapted “complex ideas and methods from life insurance, pension, and banking companies for a new charitable purpose.”

The professionalization of gift annuity programs can be traced back to a national conference on philanthropy held in Atlantic City March of 1927 that brought leading bankers, economists, attorneys, life insurance agents, public officials, marketing experts and nonprofit officers together.

The gift annuity agreement is a lifelong contract between a donor and a charity and is an irrevocable transaction. Since the income amount is fixed and never fluctuates, it provides the donor(s) a predictable income for their retirement or other estate planning strategies. The amount of the income is determined by the donor’s age. This is a tax efficient way to support a 501(c)(3) organization and receive benefits for yourself.